A frequent guest in informal conversations is the elephant in the room. The expression refers to a topic that, rather than being taboo, manifests itself as a latent risk to the balance of the environment, but becomes difficult to identify and therefore to name. The simple fact that it is there, latent, speaks of the fragility of the environment itself and of the possibility that many of the aspects that are today promoted as an achievement can be drastically modified when the elephant begins to shake.

In times of six-year synthesis, it is inevitable to take stock of what went well and balance it with what went wrong. In the era of narratives, moreover, the cadence of the stories usually imposes the coldness of the figures. While the narrative is adapted to desires, the data cannot be molded to suit our aspirations.

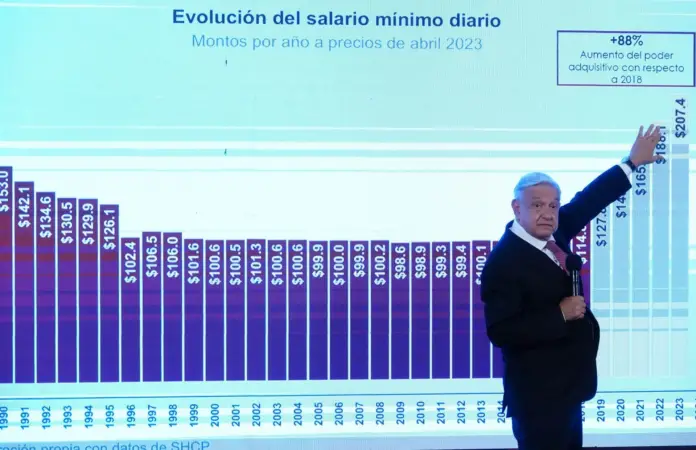

The six-year term ends and it is noticeable that the conversation highlights the decrease in poverty and the growth of salaries. Whether it is the minimum wage or the average IMSS contribution wage, which are binding for 40% of the employed population, or the per capita labor income and the wage bill, the account for the six-year period looks favorable: double or triple-digit growth in the accumulated between the fourth quarter of 2018 and the second quarter of 2024.

Of course, higher wages are combined with increasing public spending on direct transfers to households, with which the availability of income for families grew and this has contributed to reducing the percentage of people in poverty. Up to this point, it seems that the room is not disturbed.

The shadow of the elephant appears when we evaluate economic growth. It is true that the boost in wages contributed to an expansion of private consumption, with which the economy as a whole accumulates a growth of 4.5%. However, this has been the lowest for a federal administration in the last 4 decades. Thus, when we control for growth by demographic dynamics, the shadow of the elephant begins to be more threatening: 0.2% if growth of 1.57% materializes this year.

The elephant in the room begins to stare at us from the darkest corner of the room. Is this growth in wages sustainable? It seems not. The labor productivity of the economy has contracted in the reference period, which puts the sustainability of wage growth in a difficult position and makes us reflect on the consequences that this inertia will have on the well-being of families if the gap is not corrected.

The implications of this discrepancy are multiple. Starting with the upward pressures on the labor costs of companies that can be reflected in higher prices for goods and services. This, of course, depends on how competitive the labor market is and the markets where these products are sold. Our elephant is already beginning to shake.

Gradually, this pressure on the costs of companies will be reflected in higher prices for people who consume. If companies pay a salary above the productivity of their workforce, they will do everything possible to pass that cost on to their clients, and if the situation compromises the company’s liquidity, it can also cause significant reductions in the workforce. In short: inflation and unemployment with upward risks.

The elephant in the room before the end of the six-year term is labor productivity. The institutional conditions were not created for people who work, and who on average earn more today, to increase their productivity. There are the issues of public safety, energy deficits, mobility challenges, the abandonment of care systems, the halt to the promotion of economic competition in transversal input markets, the disconnection between the productive sector and academic centers… The shadow of the elephant hangs over a long etcetera.

Source: imco