Residents of Mazatlán woke up early to pay their property taxes and benefit from prompt payment discounts. Mr. Guadalupe Zepeda Lizárraga was the first to take advantage of the discount for prompt payment and for being a senior citizen. He mentioned that he wakes up early every year, getting up at 4:00 AM and lining up by 5:00 AM to be the first to make the payment.

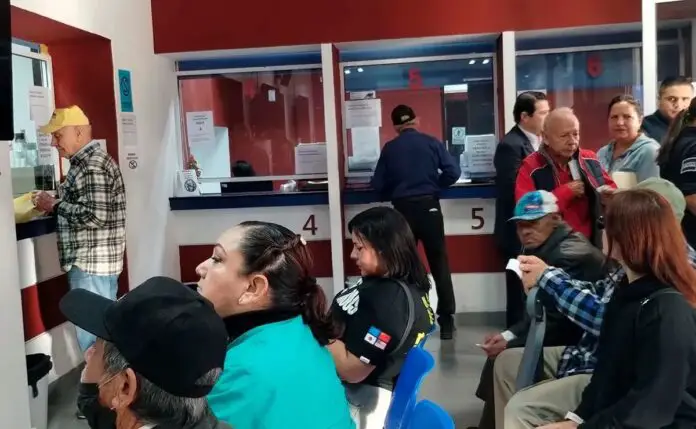

By 7:00 AM, five people were in line, and by 8:00 AM, when the offices opened, there were already 20 citizens. Payments were processed quickly, thanks to the five service boxes available in the offices. Additionally, there are two modules in the hallways for those with delayed payments.

This year, property tax increases in Sinaloa range from 2.5% to 4.0%, all below the inflation rate recorded in 2024, according to Deputy Ambrocio Chávez Chávez, president of the Public Finance and Administration Commission. The highest increase of 4.0% will apply to six municipalities but remain below the inflation rate.

For properties in Ahome, Mazatlán, and Salvador Alvarado with cadastral values exceeding three million pesos, the increase will be 4.48%. In Rosario, the increase will be 4.40%; in Cosalá, 4.14%; and in Culiacán, 4.58%.

For the new municipalities of Eldorado and Juan José Ríos, the tax tables of their former municipalities will apply. Eldorado will use Culiacán’s tables, while Juan José Ríos will use those of Ahome, El Fuerte, Sinaloa, and Guasave.

This year, Mazatlán residents will pay 4.0% more than in 2024, following the approval of the rulings by the State Congress.

Source: Debate