Chips have transformed the world, changed the way we live and the security of nations, so for Chris Miller, professor of international history at the Fletcher School at Tufts University, control of these pieces will unleash a cold war in which the United States with Donald Trump will be one of the main protagonists and Mexico its key ally.

According to his work Chip War, named Business Book of the Year by the Financial Times in 2024, he says that since World War II the world’s greatest powers no longer fight over steel or oil, but over technology, with chips being the heart of this battle, which Washington has been losing since the beginning of the 21st century.

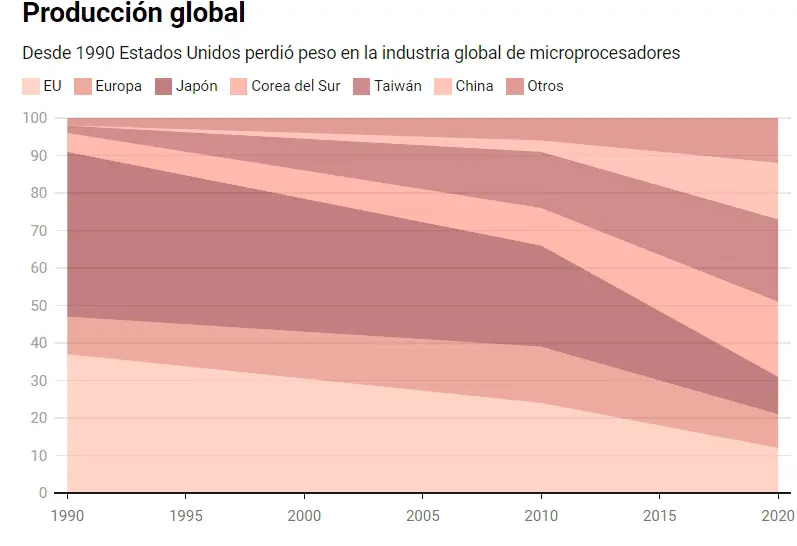

An analysis made by Statista with figures from the Boston Consulting Group (BCG) and the Semiconductor Industry Association (SIA) indicates that in 1990, Europe, the United States and Japan led production and supply with 91 percent of the global total; But when South Korea, Taiwan and China entered the ring in the 2000s, the share of the first three regions dropped to 31 percent together by 2020.

Washington is now looking to boost its industry again because according to estimates by BCG and SIA, if 50 billion dollars a year are invested in the construction of 19 plants in the next 10 years, this will have a multiplier effect on its economy since it will add up to 24 billion annually to its GDP and generate more than 280 thousand jobs.

To do this, it needs to create and consolidate internal supply chains but also with allied countries close to its territory because it does not have all the necessary elements to produce chips, this is where Mexico is a key piece in its strategy, having both qualified labor, basic infrastructure and essential inputs.

“Taiwan stole our chip business… and they want protection,” Trump said in an interview with Bloomberg Businessweek during his presidential campaign last year.

The Republican highlighted this because he believes that companies from the United States and China were allowed to take control of innovation by taking advantage of funds from the United States.

For this reason, Washington created the CHIPS and Science Act in 2022 to boost the sector and reconfigure its value chain to make it resilient, safer and more sustainable because they consider these electronic pieces essential to secure the world economy, but primarily their own.

In addition, it created the International Fund for Technological Security and Innovation, which consists of 500 million dollars and will also serve to promote the development and adoption of secure and reliable telecommunications networks.

It has already begun to distribute incentives to manufacturers such as Intel, Samsung and TSMC to strengthen their operations within that country.

Sheinbaum’s Plan

A study on nearshoring in chips created by the Mexico United States Foundation for Science (Fumec) and the United States Agency for International Development (USAID) describes that within the productive chain of said sector, the design part covers 32 percent of the value of a chip, the manufacturing part represents around 56 percent, while the assembly, testing and packaging (ATP) services 12 percent.

For this reason, President Claudia Sheinbaum presented her Mexico Plan, which concentrated the efforts made and to be applied to promote the chip industry in the country, which includes reducing by 10 percent the dependence on imported inputs and attracting ATP investments.

The Master Plan for the Development of the Semiconductor Industry in Mexico 2024-2030 also considered what was said in the Master Plan for the Development of the Semiconductor Industry in Mexico 2024-2030 to double the growth of this sector in the next five years and increase its resilience in the phases of ATP and supply of materials, leveraged in electronics, automotive and telecommunications.

To reach the goal, the possibility of reaching 10 billion dollars of investment in ATP and doubling the local supply of goods and services for the sector is proposed.

Fumec explained that Mexico offers for the global redesign of the technological supply chain and support to the United States: necessary qualified talent and existing basic infrastructure specialized in semiconductors.

This includes clean rooms, research and testing centers and a proven 30-year participation in international trade agreements in America.

It also talks about the alliances with Semiconductor Alliance Mexico, International Technology and Security Innovation Fund, USMEC-USAID, United States Technical Delegation in semiconductors and Human Capital Development.

However, there are challenges that Mexico must work on to participate in this reconfiguration; according to Fumec, in principle, the economic and development differences between the countries that participate in the T-MEC.

Also an unreliable infrastructure in terms of the provision of energy, water, telecommunications and transportation, the need to build more specialized infrastructure (the existing one has mainly academic purposes and is insufficient), the development of more technicians and engineers with a focus on SC and the lack of security in the country in general are mentioned in the document.

For this, they say that incentives and public investment in labor force and infrastructure are required, as mentioned above.

In Mexico, according to data from Fumec, the chip industry is already present in 12 states and in at least three, four of the five phases of the value chain are carried out: design, testing, assembly, integration and commercialization, where investment is already arriving.

These are Aguascalientes, Baja California, Chihuahua, Mexico City, Durango, Guanajuato, Jalisco, Querétaro, Nuevo León, Puebla, Sonora and Tamaulipas.

Dialogue

At the beginning of 2024, the United States Department of State established an alliance with the Government of Mexico to explore opportunities for growth and diversification of the global chip ecosystem.

In Mexico, the chip industry already has a presence in 12 states.

Its Chief Economist, Chad P. Bown, said during the Second Summit of Leaders of this sector of the Association of the Americas for Economic Prosperity (SCLIS-AAPE) that protecting these technologies from misuse that threatens their national security is another of its objectives, for this, it is necessary to create, together with its allied countries, regulatory environments that generate confidence in investors for the protection of the supply chain.

This was accompanied by the creation of funds to develop investment programs that generate data and train a qualified workforce in the sector, as well as build a robust energy infrastructure.

Source: milenio