Mexico is holding its breath as Donald Trump takes office. The Republican’s promise to impose a tariff wall on his first day at the helm of the United States has Latin America’s second largest economy and the rest of the world on edge. In line with his protectionist vision, Trump made tariffs a campaign weapon and now profiles them as one of the pillars of his next administration. The tycoon threatens to impose a generalized 25% tax on Mexican imports if the Sheinbaum government does not control drug trafficking and migratory flows. The probable turn in international trade due to these threats has shaken markets and dragged down the main currencies. Mexico has not been the exception. The Mexican currency closed the week with a depreciation of 0.37%, trading around 20.79 pesos per dollar, reaching a maximum of 20.93 pesos per dollar, a level not seen since July 2022. Thus, the peso added four consecutive weeks of depreciation, accumulating a fall of 3.57%. Forecasts from financial headquarters point to a greater depreciation once Trump is inaugurated. Analysts take this new tariff onslaught for granted, but question its magnitude and the pace of its implementation. In any case, the consequences of the impact will involve a deepening of the falls in the peso, higher inflation and lower rates of remittances, investment and, therefore, a slowdown in economic growth.

The recent announcement by the tycoon of the creation of an External Revenue Service to collect these new tariffs shows that the so-called “tariff wall” will be a priority as soon as his term begins. In response to the Republican’s threats, Claudia Sheinbaum’s government has also deployed its own cards. Mexico has proposed a plan to replace Asian imports with North American regional production. In addition, just starting this year, Sheinbaum’s administration imposed a 19% tariff on products imported from countries such as China through online platforms such as Temu or Shein, a decision that is a nod to the United States. In unison, the president has closed ranks with American and Canadian businessmen to defend commercial integration and has increased the seizures of fentanyl and pirated products from China. This week, the president briefly assured that her Administration already has a very elaborate plan, in case Trump starts his presidency with massive deportations of migrants and they are only waiting for the first announcements from the Republican to make it known. The president and her Cabinet have pointed out, on different occasions, that a tariff war would harm both countries and, specifically, will cause an escalation of prices for the American consumer.

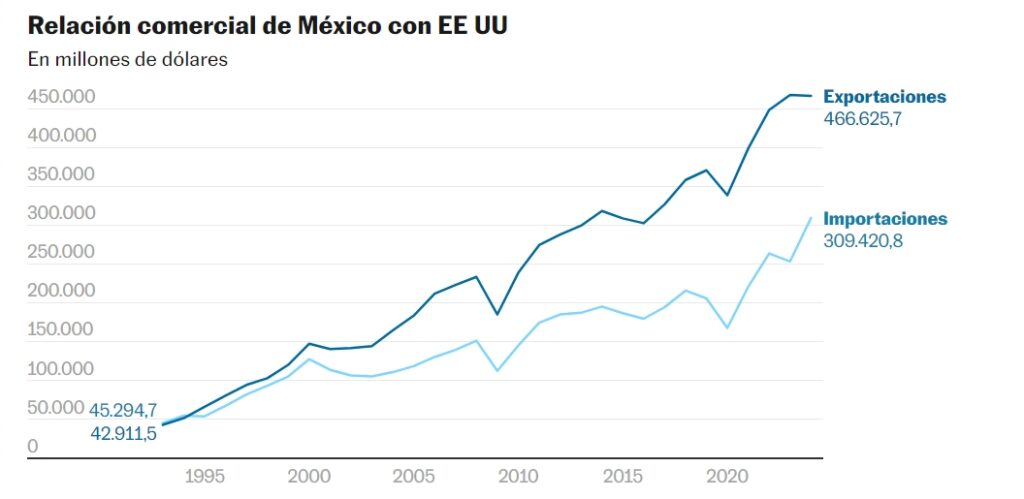

Sheinbaum will face one of her greatest economic challenges starting this Monday. Trump’s policies will force her to rethink the relationship with the United States and look for alternatives to minimize the impact of Hurricane Trump and guarantee that Mexico remains the main commercial partner of the United States, with exports to that country for more than 466,000 million dollars, 80% of the world shipments that Mexico makes. In addition to finished vehicles and auto parts, Mexico provides the United States with mechanical, medical, and electronic equipment, beverages, liquor, fruits, vegetables, among others. Binational ties also include the multimillion-dollar flow of remittances and US investment in Mexican territory. As of last November, compatriots living on the other side of the Rio Grande sent more than 5.4 billion dollars to their Mexican relatives, an increase of 10% compared to the first 11 months of the previous year. In terms of investment, US companies lead the injection of foreign capital with 14.474 billion dollars, 41% of the total Foreign Direct Investment captured by Mexico. These two important sources of income for the Mexican economy are now also in danger with the arrival of Trump to the White House.

The mere threat of imposing more tariffs on Mexican imports is a challenge to the spirit of free trade and puts the USMCA, a vital trade agreement for the integration of Mexico, Canada and the US, in jeopardy. On more than one occasion, the Republican has questioned the viability of the trade agreement. Thus, a harsh review is anticipated under Trump’s mandate in June 2026. “The treaty has greatly benefited the United States in terms of employment and production. Mexico, the United States and Canada complement each other. If we strengthen our region, we will be more competitive compared to other areas of the world,” Sheinbaum argued this week from the National Palace.

A 25% tariff would impact key Mexican export sectors, in the automotive and manufacturing sectors, and therefore, in attracting new investments and creating jobs. Mexico is the main commercial partner of the United States, even above China and Canada. The tariff threats by the Republican leader hit head-on the expectations of growth above 2.5% of the Mexican economy this year made by the Sheinbaum Government. Most multilateral and financial organizations are forecasting lower growth in the face of Hurricane Trump. This Friday, the International Monetary Fund (IMF) forecast a growth of only 1.4% for Mexico and warned about the risk that the new US Administration poses for emerging economies. Ignacio Martínez Cortés, coordinator of the Laboratory of Analysis in Commerce, Economy and Business at UNAM, agrees that Mexico is in a critical position at the moment and anticipates financial volatility, depreciation and a major change in the commercial relationship between Mexico and the US upon Trump’s arrival at the White House.

Source: elpais