The construction industry, a strategic sector for the Mexican economy during the government of Andrés Manuel López Obrador, is in a period of crisis after the completion of flagship works and a new infrastructure policy.

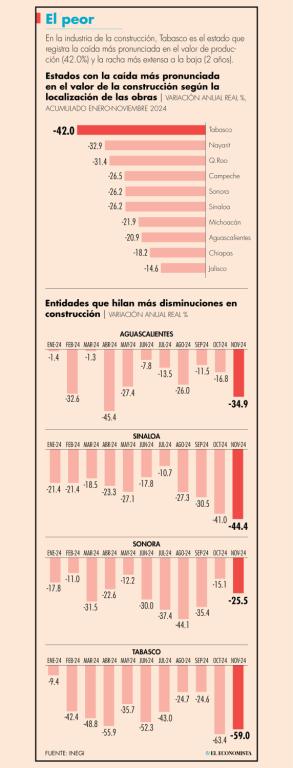

At the subnational level, Tabasco is the state most immersed in a recession in the sector, since last November, it has had two years with annual declines in the value of production, according to data from the National Institute of Statistics and Geography (Inegi).

The oil entity was followed by Aguascalientes, Sinaloa and Sonora, each with a streak of 11 months with declines in the construction industry.

“The economy of Tabasco is closely linked to the oil industry, the fiscal situation of Petróleos Mexicanos (Pemex) and the decrease in oil extraction have generated an industrial crisis in the region; The state-owned company has debts with local suppliers, whose lack of payment affected the operation of companies, especially small and medium-sized ones, resulting in the loss of formal jobs,” explained economic analyst Héctor Magaña.

Added to this crisis situation is the completion of the Mayan Train and the Dos Bocas refinery, works for which the entity had high investment values and jobs in the sector, which have been declining, generating a contraction in the construction industry.

For its part, in Sinaloa, the lack of specialized workers in the construction industry, as well as the growing problems of insecurity that the entity is going through, “have compromised the development of projects in the region,” added the expert.

Changes in construction

Despite the perception of a boom in the construction sector in Aguascalientes, the construction subsector, which includes the construction of residential housing, has not shown a positive performance as in previous years, explained Dafne Viramontes, president of the College of Economists of Aguascalientes.

“This slowdown could be related to national and international factors that affected the prices of inputs and generated uncertainty among companies, the year 2024 was a complicated period to invest in the construction sector due to market conditions,” she said.

“Construction in Aguascalientes has been fluctuating, but with an upward trend during 2024, according to data from the Quarterly Indicator of State Economic Activity (ITAEE), in the first nine months of the year, there was an accumulated growth of 2.9%, which seems to be linked to investment in water, electricity and telecommunications infrastructure,” she added.

Caution

For Kristobal Meléndez, economic and financial analyst, he pointed out that the fall in construction is due in part to a change in the housing model, so some projects are being cautious about the new rules and the focus on the rehabilitation of abandoned housing.

“Once the new model is established, construction levels will recover,” he added.

“Although there are indicators that allow us to identify adequate behavior in the construction sector in Aguascalientes, the construction subsector could still see changes in the near future, with the start of a social housing program promoted by the state government for 2025, which could influence the growth of this segment in the coming months, without neglecting investments in urbanization and transportation works,” added Dafne Viramontes.

In the case of Sonora, its performance may be related to the high interest rates still in force that make financing for construction projects more expensive, “which can discourage both investors and developers; if market conditions are added to this, it can lead to delays or cancellations.”

Source: eleconomista