Online financial services are an option offered by banking institutions for money management and the Tax Administration Service (SAT) is the body that regulates that these movements respect the legal obligations.

Although banks have their internal regulations that stipulate the amounts that can be used for electronic banking, the SAT is the great beneficiary with the use of transfers as they have certainty of the origin and destination of the money.

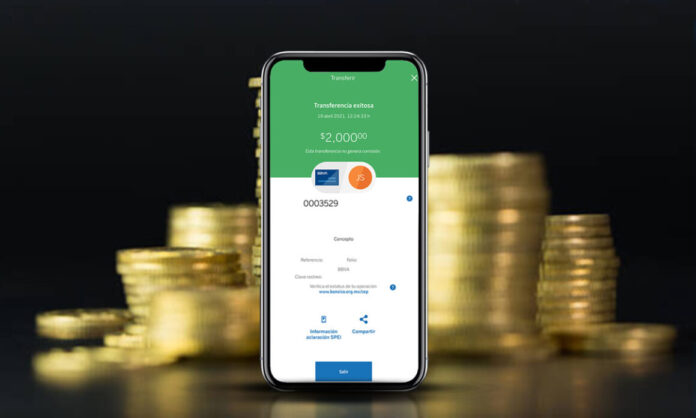

Transparent concepts, according to the SAT

In addition to this specification, the decentralized body of the Ministry of Finance and Public Credit pays attention to the concept that is used when making a bank transfer.

In this way, the SAT monitors compliance with tax law, avoiding murky processes and ensuring the good management of taxpayers.

In view of this, it is most advisable that in “concept” people put the real reason for the transfer, whether it is related to a payment, a purchase or a deposit between relatives.

Some basic examples are the following: payment of electricity, payment of water and payment of tuition. It could also be used for purchases at the supermarket, food order or rent.

What not to do in a bank transfer

The SAT advises that the “concept” section should never be left blank (empty) because it complicates or does not allow identifying and classifying the reason for this.

It also recommends not using bank transfers to make jokes. This is emphasized since in recent years it became “fashionable” to resort to the use of expressions in the concept to draw someone’s attention, which is common among ex-partners who send “I miss you” or “call me” instead of a real reason.

In both cases, the SAT may consider that these are false movements, especially because there is a problem that occurs frequently: the frontmen.

Source: El CEO